Recent updates to Google Hotel Finder metasearch change the way its users will find lodging. This article will explore the three major changes and how our bed & breakfast inn, boutique hotel and other distinctive lodging clients can stay competitive as Google makes Hotel Finder metasearch more sophisticated and begins to enter the Online Travel Agency (OTA) market.

Last month, I reported on the testing of direct online booking by Google Hotel Finder. Since then, Google has rolled out other major changes to its hotel metasearch – namely more map-driven data, mobile surveys for crowd-sourcing data and a new Hotel Ads commission that expands upon the online booking tests it performed earlier this summer.

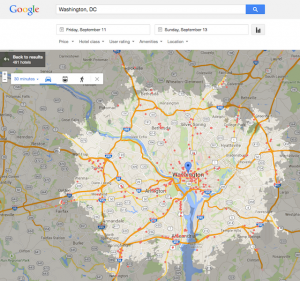

Google Hotel Finder Increases Importance of Google Maps

Google aims to improve the user experience with their Google Maps results in the Hotel Finder metasearch. This change gives the “location-location-location”-minded traveler exactly the kind of information they need to make decisions. For lodging providers this essentially means there’s no more hiding behind vague “we’re close to” such-and such statements in Google Hotel Finder. By looking at the integral map, Google Hotel Finder users will know exactly where you, and your competitors, are situated relative to whatever attractions interest them.

It’s very important that your Google My Business listing has an accurate map location. A correct street address won’t always do this for you, so check your business’ location on the map. If it isn’t in the right place report the incorrect map marker location to Google.

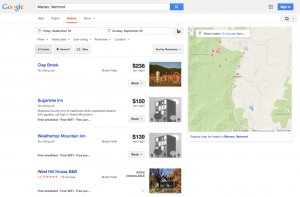

The List View

In the list view, the default order for results is “By Relevance,” but what does that mean in terms of rank position? Like organic search results in Google, it’s a lot of factors, but primary among these is the availability to book via at least one OTA such as Booking.com, Hotels.com, Expedia or Priceline. Have a look at this admittedly anecdotal sample (click on it for a larger view):

Each of the top 3 offer online booking via OTA. The #1 listing has no description, no ratings, no amenities list, and a photo. It is not closest to the geographic center of town. The story was the same for other locations I reviewed: online booking options equal higher rank compared to other listing components.

Google Hotel Finder Surveys for Mobile Users

As with directory and review sites that are venturing into the OTA market, such as TripAdvisor, Google will use user opinion as a way of crowd-sourcing data and apply it to their ranking of lodging businesses in Hotel Finder. The survey component currently applies to users of mobile devices currently, which indicates Google is testing it in a limited market to determine if it will become a useful source of user interaction and data.

Google has a long uphill battle for relevance in the user opinion market when going up against the likes of TripAdvisor.

New Google Hotel Finder Ads Commission Program Includes Direct Booking

Until recently, Google Hotel Finder only offered booking though paid Google advertising by OTAs such as Booking.com and Expedia or select Central Reservations System (CRS) provides on their exclusive Google Hotel Price Ads program. Now, Google is partnering with Sabre Global Distribution Systems to handle reservations and payment processing directly via the Google Hotel Finder interface using Google Payments. Hotels participating in this program pay commissions to both Google and the participating Global Distributions System (GDS) booking partner. Sabre is currently the only known GDS participating in the program.

Until recently, Google Hotel Finder only offered booking though paid Google advertising by OTAs such as Booking.com and Expedia or select Central Reservations System (CRS) provides on their exclusive Google Hotel Price Ads program. Now, Google is partnering with Sabre Global Distribution Systems to handle reservations and payment processing directly via the Google Hotel Finder interface using Google Payments. Hotels participating in this program pay commissions to both Google and the participating Global Distributions System (GDS) booking partner. Sabre is currently the only known GDS participating in the program.

It is important to note that this hotel direct booking program is currently only available to users of mobile devices, who tend to be convenience-minded, but that is likely just the testing ground.

For B&B, boutique hotel and other distinctive lodging providers, this is yet another area where you need to evaluate and monitor your competition before making the decision to add a test of the Sabre GDS to your the existing internet marketing efforts you’re making via your website, OTAs, Cost-Per-Click (CPC) advertising, online directories and link partners.